Lecture 4 – Living on the edge of chaos

From the 1999 lecture programme:

Even in our everyday lives on Earth, there are many phenomena which seem to show self-organised behaviour which emerges in time, despite a seemingly chaotic environment.

In fact it has been suggested that such critical states, delicately balanced as they are between complete order and utter chaos, occur throughout nature: possible examples include earthquakes, forest fires, avalanches and biological evolution.

Human activity can also be included: for example it has been shown that traffic on a motorway will evolve in time to a state where there are traffic jams of all sizes, and that this situation is actually the most efficient that can occur. The traffic system hence evolves in time so as to optimise some global pay-off, even though the individual drivers are each acting selfishly!

This idea of self-organisation to a critical, yet somehow efficient, state where there are fluctuations of all sizes may offer a new principle for describing how our world evolves in time.

Another fascinating example of such critical behaviour is offered by the world's financial markets. We all know, sometimes to our cost, that market crashes can suddenly occur. But is there any hope of predicting when these large movements will arise, and do they follow some universal law?

Remarkably, the model of market movements being used by banks world-wide is based on plant pollen! It was the botanist Robert Brown who, in 1827, discovered the seemingly random motion of pollen particles under his microscope. This finding led to a mathematical model, called Brownian motion, upon which all modem financial theory is now based.

However, this theory cannot account for the large market movements which seem to arise every few years, and which have such costly consequences for many of us.

About the 1999 CHRISTMAS LECTURES

Physicist Neil Johnson looks at the concept of time in these CHRISTMAS LECTURES from 1999.

From the 1999 Lecture brochure:

What is time? Can we make it go backwards? Will it ever end – if so, how and when?

In our daily lives, we often find ourselves battling against time: we may blame it for slipping by too quickly, but are unable to stop it. On other occasions, such as during the Millennium celebrations, we happily celebrate its passing. Yet what would we do without it? There would be no way of running our everyday world: no night, no day, no Christmas, and no Christmas Lectures!

Phrases such as 'time is money', 'against the clock' and 'no time to lose' are typical of our love-hate relationship with time's steady march forwards. But why forwards? And how steady? These are very difficult, yet fundamental, questions that scientists are still trying to answer.

From a mathematical point of view, time is just another 'dimension' like space. However, it is a very mysterious and fascinating one. Our world seems to depend fundamentally on the fact that time moves forwards, not backwards. Although we travel around freely in space, time travel still lies beyond us.

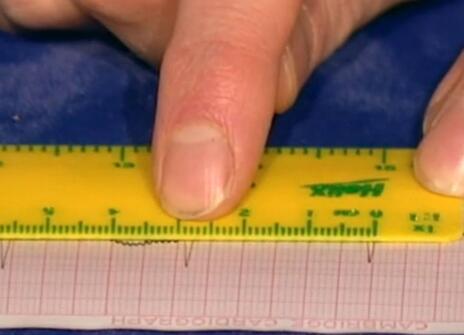

What is the time? That question seems like it should be much easier to answer. After all, you just need to glance at your watch. But what if you had no watch, how would you go about measuring time?

It turns out that much of our own history is intertwined with this quest. As we have refined our understanding of how to measure time, we have become aware of the crucial role it plays in our world. Early clocks such as sundials relied on the motion of the heavenly bodies. Then came mechanical devices based on the periodic motion of a swinging pendulum.

More recently, we have turned to the ultra-small quantum world to devise atomic clocks which enable us to synchronise events in different places with amazing accuracy. The reliability of modern-day navigation, commerce, telecommunications and manufacturing depends heavily on such synchronisation.

Interestingly, however, there are many phenomena in our everyday world that can not be described using a regular time-scale. Traffic jams, stock market crashes, and earthquakes all seem to arise in an irregular, almost chaotic way. Does this mean we can never predict when they will occur?

These Lectures take us on a journey through time. We will travel from the vast time-scales of the Universe bounded by the intricate fabric of space-time itself, through our rapidly changing everyday world to the ultimate limits of the unbelievably small quantum world upon which all of life ultimately depends.

Our journey touches the outer limits of the current scientific understanding of the role of time in our world. This understanding has changed dramatically since the founding of the Royal Institution two hundred years ago. As for the surprises which await us in the future, only time will tell!

However, there are many recent scientific discoveries that provide exciting glimpses as to what may lie ahead, such as teleportation, the possibilities for time travel and the fate of the Universe itself.